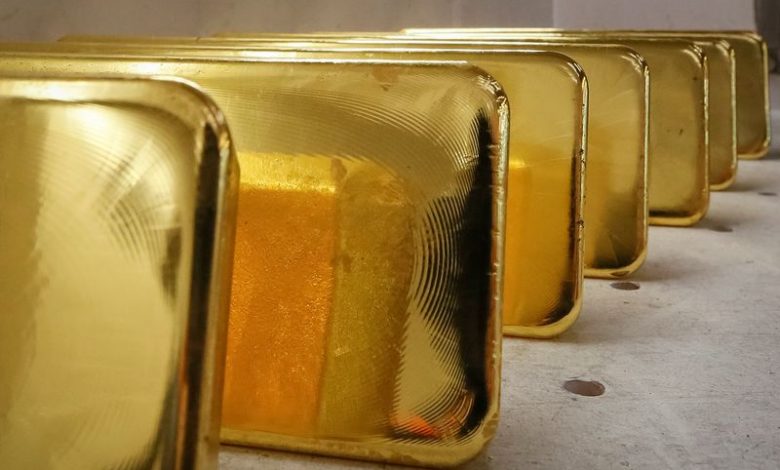

Gold Rises to Over One-Week High as Dollar Declines

By Gina Lee

Gold prices increased on Monday morning in Asia, reaching their highest level in over a week. The yellow metal has been supported by a weakening dollar, despite rising U.S. Treasury yields limiting its gains.

Gold rose 0.62% to $1,853.46 by 1:13 AM ET, with prices previously touching $1,853.55, the highest since May 12.

According to OANDA senior analyst Jeffrey Halley, "The jury is still out as to whether gold has weathered the storm in the medium term, or if it is merely rallying in response to a sustained pullback by the U.S. dollar."

The dollar index, which typically moves in the opposite direction to gold, fell on Monday after experiencing its first weekly loss in nearly two months. Meanwhile, benchmark Treasury yields firmed after a three-session decline.

Halley added, “Before turning structurally bullish, I would need to see gold hold onto its recent gains in the face of dollar strength, not dollar weakness.”

The U.S. Federal Reserve is set to release the minutes from its latest meeting on Wednesday. St. Louis Fed President James Bullard has emphasized the need for the Fed to raise interest rates to 3.5% in 2022 to address inflation more effectively.

In the Asia-Pacific region, the Reserve Bank is expected to announce its policy decision on Wednesday, followed by another central bank’s announcement a day later.

In line with market sentiment, the SPDR Gold Trust reported that its holdings rose by 0.69% to 1,063.43 tons on Friday, up from 1,056.18 tons the previous day.

In other precious metals, silver gained 0.4%, platinum increased by 0.3% to $958.10, and palladium rose by 0.7%.

GOOGL

GOOGL  META

META