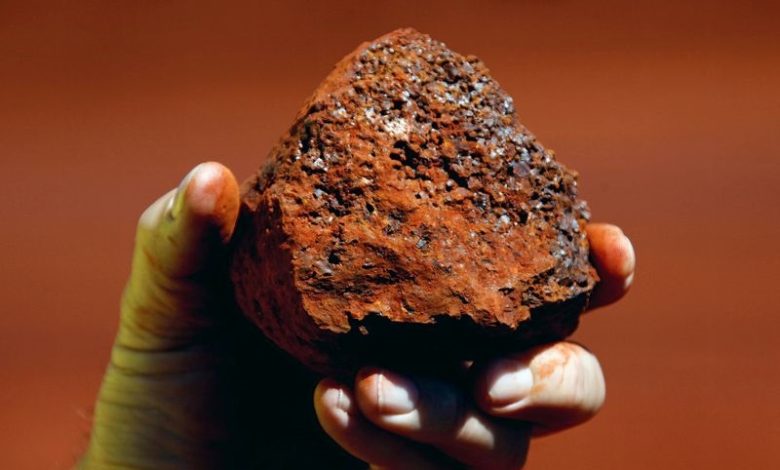

Goldman Lowers Iron Ore Price Forecast, Emphasizes Need for Supply Cuts

Goldman Sachs has updated its price forecast for iron ore in the fourth quarter of 2024, lowering it from $100 per ton to $85 per ton. This revision is driven by increasing concerns over an oversupply in the global iron ore market, which has been impacted by strong shipments and declining demand from China.

Analysts at Goldman Sachs have indicated that if there are no significant supply reductions, the market will continue to be out of balance, which will put further downward pressure on prices. Recently, the spot price for 62% Fe iron ore plummeted to a near two-year low of $90 per ton, representing a 20% decline since July 2024.

Despite the drop in prices, global iron ore supply remains strong, with daily shipments up by 2% compared to the same time last year. This consistent supply, combined with weak demand, is pushing the market towards a surplus.

The analysts noted that even though India has cut back on exports, a substantial demand recovery seems unlikely. They predict that producers with higher costs will also have to reduce output to restore market balance, especially considering that port stocks are currently 30 million tons above the average for the period from 2016 to 2023.

While there are signs that iron ore consumption in China is stabilizing, the overall demand is still weak. The country’s macroeconomic outlook is grim, with a GDP growth forecast revised down to 4.7% for 2024, implying that domestic demand is unlikely to recover significantly and support iron ore prices.

Moreover, the outlook for Chinese steel production, closely linked to iron ore demand, is fraught with uncertainty. Steel exports saw a 21% month-over-month increase in August after two months of decline, but the potential for falling exports may further suppress demand in the long run.

Given the ongoing oversupply, Goldman Sachs analysts contend that producers with higher production costs must implement supply cuts to rebalance the market. They suggest that prices may need to fall to around $80 per ton to eliminate excess supply from India and other marginal producers, which would pressure lower-cost producers to reduce production.

In the immediate future, Chinese steel mills might engage in restocking ahead of the “Golden Week” holiday in early October, potentially providing temporary support for iron ore prices. Recent data indicated a 2.6% week-on-week increase in iron ore stocks at steel mills, marking the largest increase since the period before the Lunar New Year. However, this restocking is not expected to significantly alleviate the broader market surplus.

GOOGL

GOOGL  META

META