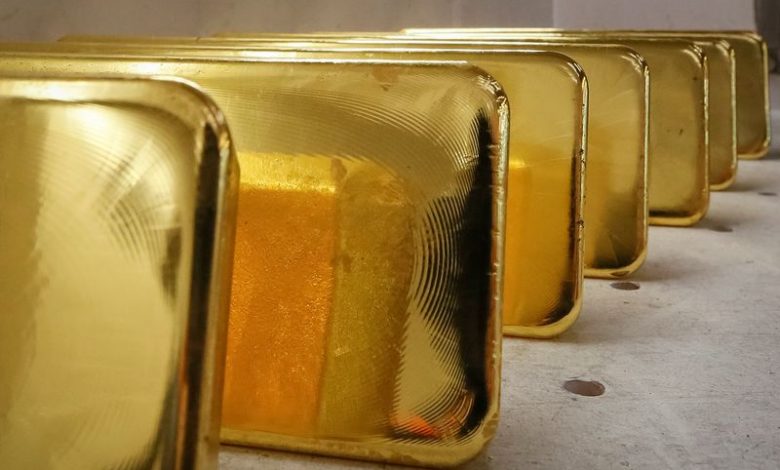

Gold Rises Amid Continued Inflation Uncertainty

By Gina Lee

Gold prices increased on Wednesday morning in Asia, driven by uncertainties surrounding inflation.

Gold was up by 0.26%, trading at $1,860.30 by 11:39 PM ET (3:39 AM GMT). The U.S. dollar, which typically moves inversely to gold, experienced a slight uptick following a fall to a one-month low in the previous session. Benchmark yields also stabilized after dropping to a one-month low earlier.

“Investors are grappling with how to evaluate the trajectory of inflation now that peak levels have passed. The market is curious about how long normalization will take, and this uncertainty is benefiting gold,” noted Stephen Innes, managing partner at SPI Asset Management.

The U.S. Federal Reserve is combating inflation at a 40-year high and is contemplating significant interest rate hikes. Recently, Raphael Bostic, president of the Federal Reserve Bank of Atlanta and a member of the central bank’s dovish faction, advocated for a cautious approach to policy tightening in an essay published by his bank.

“Gold investors are observing the softer tone in the Fed’s messaging, and dips to $1,850.00 are encountering robust support,” Innes added.

Market participants are now looking forward to upcoming policy announcements for further insights.

In the Asia-Pacific region, a central bank raised its interest rate from 1.5% to 2.0% as anticipated, while another central bank is expected to make its policy decision on Thursday.

Among other precious metals, silver saw a decline of 0.2%, while platinum edged up by 0.1%, and palladium dropped by 0.5%.

GOOGL

GOOGL  META

META