Soft China Data Dampens Sentiment in Industrial Metals Market

Chinese economic recovery post-pandemic continues to be a concern for investors, particularly within the industrial and infrastructure-related metals market. Recent data indicates a slowdown in industrial production and a decline in investments in metal-intensive fixed assets, leading to mixed perspectives among market analysts, as highlighted by Julius Baer in a recent client note.

Carsten Menke, Head of Next Generation Research at Julius Baer, expressed caution regarding metals more closely tied to the real estate market, while maintaining a constructive view on others. However, he noted that prices are likely to remain stable due to the lack of signs indicating an industrial recovery.

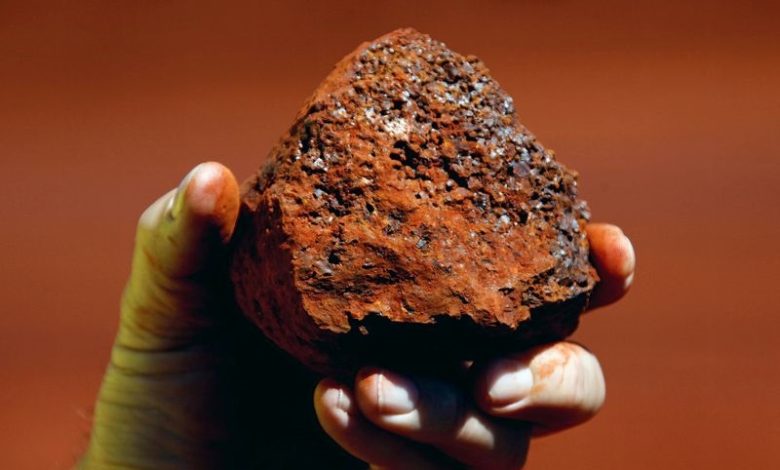

Menke observed that iron ore prices appear to have lost their “stimulus hope premium,” maintaining a neutral stance on the outlook for these commodities. Furthermore, steel prices in China have reached their lowest since the last seven years, with no expected change in this situation for the near future.

In contrast, copper has been influenced by hopes surrounding a global industrial recovery. Menke described the recent price correction as a “cooling of the overly optimistic market climate” and maintained a positive long-term view on copper prices, though he cautioned that they should remain “within limits” as indications of a global recovery remain scarce.

GOOGL

GOOGL  META

META