TSMC and Samsung Discuss Building Chip Factories in UAE: WSJ

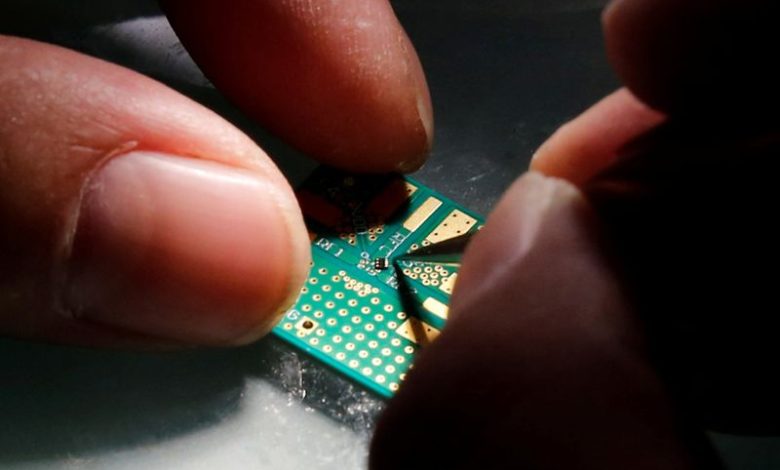

Samsung Electronics and Taiwan Semiconductor Manufacturing Company (TSMC) are reportedly in discussions regarding the potential construction of large semiconductor plants in the United Arab Emirates, according to a report by The Wall Street Journal.

These facilities could significantly enhance the region’s influence in the advancement of artificial intelligence technologies.

Executives from TSMC, the world’s leading semiconductor manufacturer, recently traveled to the UAE to assess the feasibility of establishing a manufacturing complex that rivals its most advanced plants in Taiwan. In a similar vein, high-ranking officials from Samsung have also explored the possibility of setting up major chip production operations within the country.

While these talks are still in the early stages, they face various challenges, including technical considerations, which could hinder the realization of the projects. Reports indicate that the total investment for the factories could exceed $100 billion.

It’s expected that the projects would receive support from the UAE and its sovereign wealth fund, Mubadala, as part of a broader initiative to cultivate a domestic technology industry.

GOOGL

GOOGL  META

META