Economy Making Progress, Though Recovery is Incomplete

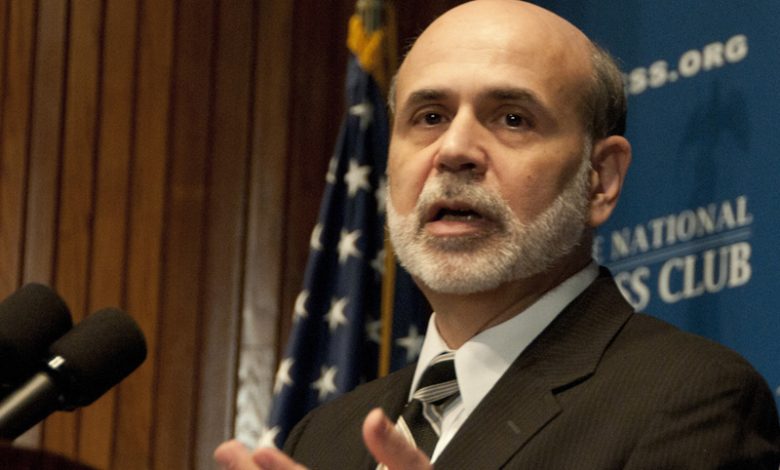

The U.S. economy is showing signs of recovery, although it remains incomplete. Outgoing Federal Reserve Chairman Ben Bernanke emphasized on Friday that any decision to reduce stimulus measures, such as monthly bond purchases, should not be interpreted as a move toward tightening monetary policy.

Currently, the Federal Reserve is purchasing $75 billion in bonds each month as part of its quantitative easing strategy, aimed at stimulating the economy. This monetary policy generally leads to a weaker dollar by lowering borrowing costs, which often drives investors towards other asset classes like stocks.

In December, the Federal Reserve reduced its bond-buying program by $10 billion, down from $85 billion, a level maintained since September 2012. If economic conditions, particularly in the labor market, continue to improve, further reductions in the stimulus program may occur. However, Bernanke indicated that any policy tightening through raising benchmark interest rates is still a long way off.

As of November, the unemployment rate stood at 7.0%. Bernanke remarked, “Recovery clearly remains incomplete. At 7 percent, the unemployment rate is still elevated. The number of long-term unemployed remains unusually high, and other measures of labor underutilization, such as those working part-time for economic reasons, have improved less than the unemployment rate.”

The U.S. benchmark interest rate, known as the fed funds rate, is currently between 0.0% and 0.25%. The Federal Reserve has indicated that this rate will remain unchanged even if the unemployment rate falls below 6.5%, which is often seen as a threshold for considering policy tightening.

Bernanke highlighted that the 6.5% unemployment rate is a threshold, not a trigger for rate hikes, meaning that an increase in the federal funds rate might not occur immediately once this rate is reached, even if quantitative easing programs are concluded. He stated, “Crossing one of the thresholds would not automatically give rise to an increase in the federal funds rate target; instead, it would signal only that it would be appropriate for the Committee to begin considering, based on a wider range of indicators, whether and when an increase in the target might be warranted.”

Furthermore, Bernanke clarified that the decision in December to taper bond purchases did not signify a shift away from accommodating monetary policy. He stressed the importance of understanding the context of asset purchases, noting, “The FOMC’s decision to modestly reduce the pace of asset purchases at its December meeting did not indicate any diminution of its commitment to maintain a highly accommodative monetary policy for as long as needed.”

He concluded, “Rather, it reflected the progress we have made toward our goal of substantial improvement in the labor market outlook that we set out when we began the current purchase program in September 2012.”

GOOGL

GOOGL  META

META