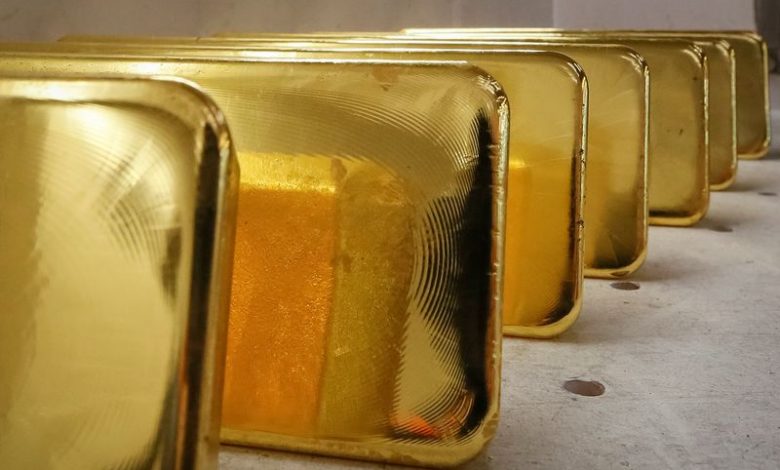

These Analysts Say Gold Currently Looks “Tactically Overbought”

Gold appears to be “tactically overbought” after reaching record highs, according to Bank of America analysts. The price of gold increased by 0.7% to $2,674.56 per ounce, while December futures rose by 0.5% to $2,697.60 per ounce.

This surge can be attributed to a significant 50-basis point interest rate cut implemented by the Federal Reserve last week, along with expectations of further rate reductions later this year. Despite these gains, Bank of America analysts noted that gold prices are currently well above their 200-day moving average, and historically, returns tend to be flat one to six months after reaching such levels.

The analysts indicated that gold investors are pricing in 150 to 200 basis points of interest rate cuts. Should the Fed’s cuts be more gradual than anticipated, the acceleration of gold prices could also decelerate. Nevertheless, they acknowledge that support for gold prices remains robust.

Attention is now turned toward an upcoming speech by Fed Chair Jerome Powell, alongside significant U.S. economic data. Powell is slated to give recorded remarks at the US Treasury Market Conference in New York.

In response to the recent large rate cut, Powell described the adjustment as a “recalibration” intended to safeguard the U.S. labor market while effectively managing inflation towards the Fed’s target of 2%. Other Fed policymakers have also supported the substantial decrease, highlighting the need to balance the fight against inflation with the potential impact on the economy.

However, not all Fed officials agreed on the extent of the cut. Fed Governor Michelle Bowman, who advocated for a more conservative 25 basis point reduction, expressed ongoing concerns about persistent inflation risks.

GOOGL

GOOGL  META

META