Gold Prices Rise as Dollar Weakens on Rate Cut Hopes

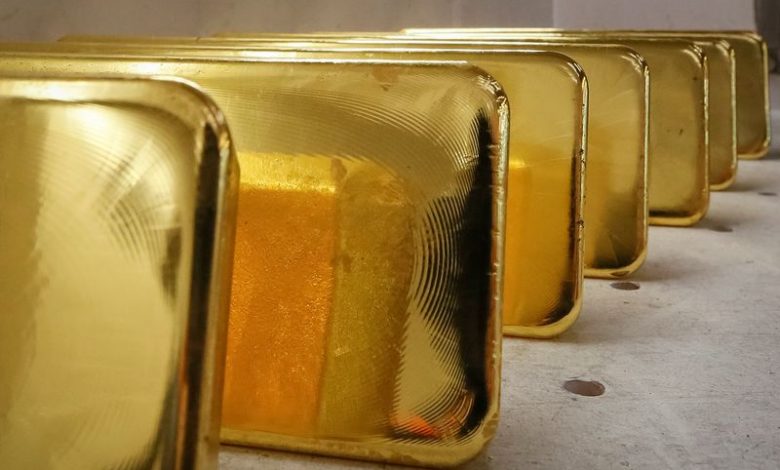

Gold prices experienced a modest increase during Asian trading on Wednesday, benefiting from a retreat of the dollar following positive remarks from Federal Reserve Chair Jerome Powell. However, the price of gold remained within the trading range established throughout most of June, as traders continued to focus on upcoming indicators regarding U.S. interest rates, which favored the dollar.

As of the latest trading figures, gold climbed 0.1% to $2,332.16 an ounce, while August futures rose 0.3% to $2,341.25 an ounce.

### Gold Gains Amid Limited Progress

The rise in gold prices followed a decline in the dollar after Powell highlighted progress in addressing inflation issues. Nonetheless, he cautioned that the Federal Reserve requires additional confidence before considering reductions in interest rates. This perspective, along with the anticipation of significant economic indicators, has kept the upward momentum of gold and other metals in check.

Attention is now directed towards the minutes from the Fed’s June meeting, which will be released later on Wednesday, along with statements from various Fed officials over the next few days. Importantly, Friday’s labor market data is expected to provide crucial insights into the current state of the economy.

Gold has shown some recent recovery as traders increased their bets that the Federal Reserve might soon pivot towards cutting rates. However, lingering worries about inflation and a robust labor market have limited gold’s advances, keeping its price around the low $2,300s for nearly a month.

Other precious metals also experienced gains on Wednesday, with silver edging slightly up to $1,012.05 an ounce and platinum increasing by 1% to $29.96 an ounce.

### Copper Prices Stalled by Weak Chinese Economic Data

In the realm of industrial metals, copper prices saw an uptick on Wednesday, benefiting from the weaker dollar. However, upward movement was constrained by disappointing economic data from China, the world’s leading copper importer. On the London Metal Exchange, benchmark copper rose 0.4% to $9,708.00 a tonne, while one-month copper increased by 0.3% to $4.4407 a pound.

Private purchasing managers’ index data from China indicated that manufacturing activity grew at a slower pace than anticipated in June, raising concerns about the nation’s economic recovery momentum. As a result, copper prices suffered significant declines throughout June due to these uncertainties regarding China’s economic health.

GOOGL

GOOGL  META

META