Gold Rally Expected to Continue Easing

The gold rally appears to be losing momentum, according to HSBC, and the precious metal may continue to decline unless there is a significant escalation in geopolitical risks.

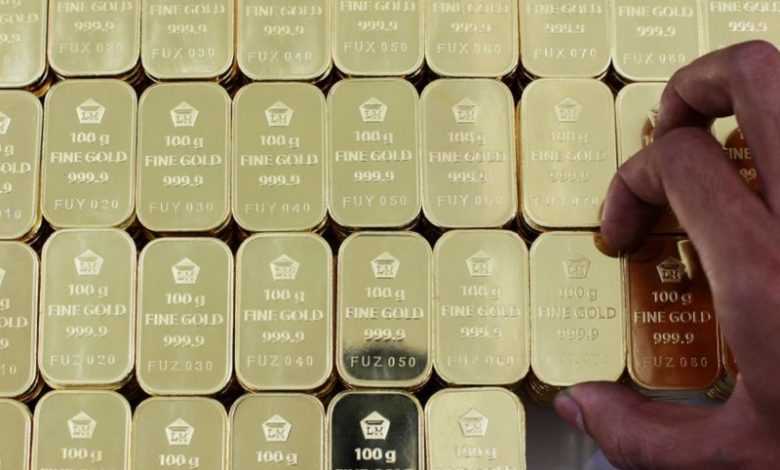

Gold prices reached an all-time high of $2,685.42 per ounce on September 26 and have surged approximately 28% this year, setting the stage for the largest annual increase in 14 years. This surge is primarily driven by the anticipated interest rate cuts from the U.S. Federal Reserve and ongoing geopolitical tensions.

However, the lack of market response to recent developments in the Middle East suggests that investors may be growing desensitized to news from that region. Analysts at HSBC noted that currently, more “safe-haven” investment appears to be flowing into the U.S. dollar rather than into gold.

According to HSBC, expectations for 50 basis points in rate cuts by the year’s end are beginning to outweigh predictions for a 75 basis points reduction, which could negatively impact gold prices. Furthermore, comments from Federal Reserve officials may carry increasing weight in market evaluations.

The upcoming release of September’s employment data could influence gold prices, especially if the results are disappointing. Although the ADP employment report was positive, there is no consistent correlation between its outcomes and those from the Labor Department.

Without significant catalysts, gold may face further declines, particularly as China, a key buyer, remains on the sidelines.

GOOGL

GOOGL  META

META