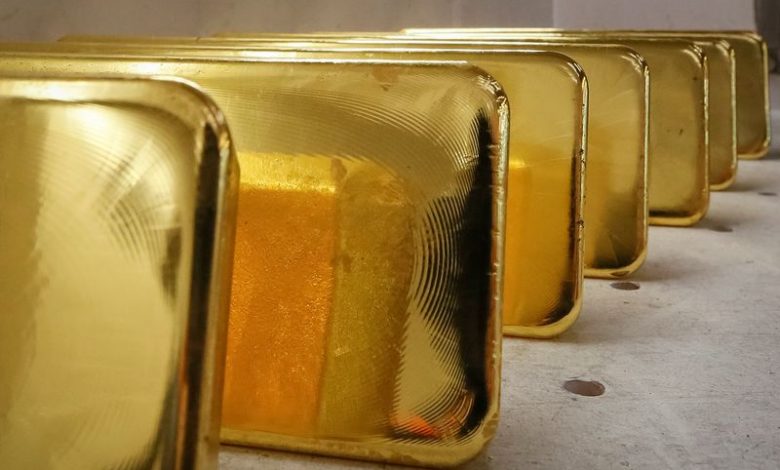

Gold’s September Performance Exhibits “Unseasonably Strong” Trends

Investors at UBS have noted that the gold market’s more than 5% rally in September has been “unseasonably strong,” defying typical trends observed over the past decade.

In a recent report to clients, analysts indicated that discussions with market participants reveal increasingly positive sentiments towards gold, although these views have not yet translated into solid investment positions. Many investors are reportedly waiting for market pullbacks to increase their exposure, but the scarcity of such opportunities may be driving prices higher as they pursue upward momentum.

Traders are also cautioning that a potential cooling in gold’s returns might be forthcoming, especially if a rebound in US economic growth prompts the Federal Reserve to adopt a “hawkish pivot,” which could maintain high interest rates and strengthen the dollar. However, UBS analysts believe that any decline in prices is likely to be limited.

The analysts further suggested that a period of consolidation in the market would be beneficial, allowing weaker positions to be eliminated and providing long-term investors a chance to enter the market at more favorable levels.

Gold prices have recently surged to new highs in Asian trading following a significant rate cut by the Federal Reserve last week. Market sentiment has been bolstered by expectations of additional cuts to borrowing costs later this year.

Several officials from the Federal Reserve expressed support for the recent 50 basis point cut, though they anticipate a slowdown in the pace of reductions moving forward. Analysts at Citi predict at least 125 basis points in cuts by year-end.

Lower interest rates typically benefit gold, as they diminish the opportunity cost of investing in non-yielding assets. The dollar and Treasury yields have fallen following the Fed’s decision, which has facilitated further gains in the gold market.

GOOGL

GOOGL  META

META