Breaking News

China Urges Local Companies to Avoid Nvidia’s AI Chips – Bloomberg

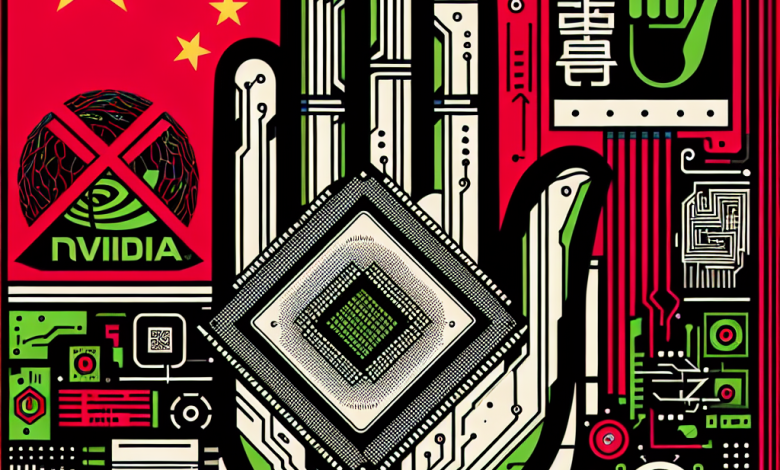

China is advising its domestic companies to avoid using AI chips from Nvidia. The government is concerned about the potential implications of these advanced technologies and the influence they could have. As a result, local firms are encouraged to seek alternative solutions that align with national interests and security considerations. This move underscores China’s commitment to developing its own technological capabilities while reducing dependence on foreign companies in the rapidly evolving AI sector.

GOOGL

GOOGL  META

META