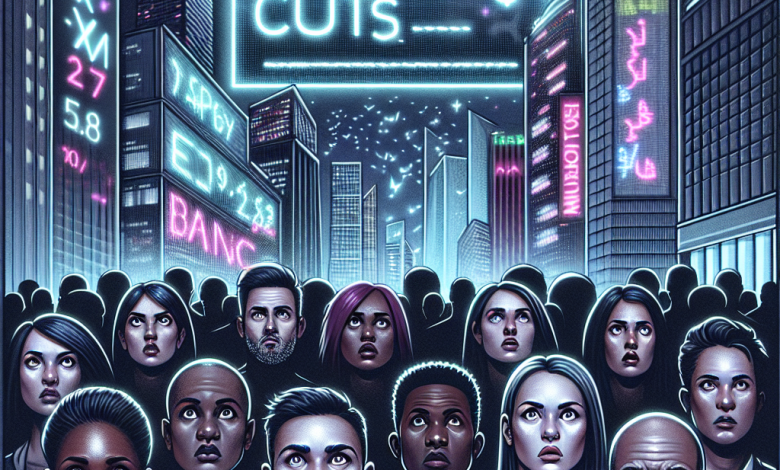

Morgan Stanley Explores the Impact of Rate Cuts on Bank Stocks

Morgan Stanley analyzes the potential effects of interest rate cuts on bank stocks. According to their research, reducing interest rates may initially boost the financial sector by lowering borrowing costs, fostering increased loan demand, and potentially enhancing banks’ profit margins on loans.

However, there are nuanced impacts to consider. While lower rates might stimulate borrowing and investment, they could also compress interest margins, particularly for banks that heavily depend on net interest income. This compression may lead to a decline in overall profitability for some institutions.

Additionally, Morgan Stanley’s findings suggest that the market’s response to rate cuts could vary depending on the specific institutions and their business models. Banks with diversified income streams or those less reliant on interest income may fare better in a rate-cut environment than those with a narrower focus.

In summary, while rate cuts can offer certain short-term benefits to the banking sector, they also pose challenges that could affect profitability and market performance in the long run. Investors should consider these various factors when evaluating bank stocks in relation to changing interest rates.

GOOGL

GOOGL  META

META