No Significant Upside Movement for SPX Ahead of Election: BTIG

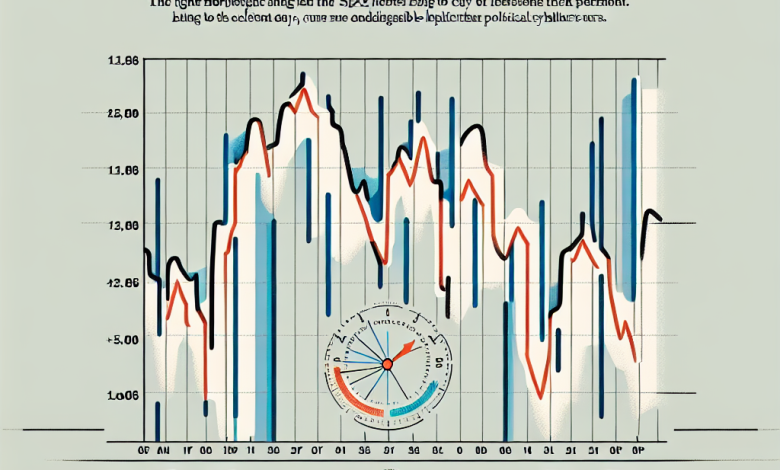

Analysts at BTIG do not anticipate a significant upward movement for the S&P 500 index ahead of the upcoming U.S. election, even though bullish trends are holding strong in the 5670-5700 range.

In a recent note, the firm indicated that while a primary breakout occurred amid recent volatility, the index is effectively “running in place.” Despite strong economic data reported last week, the S&P 500 failed to achieve new highs, leading BTIG to suggest that significant market gains are improbable before election day.

While there remains a possibility of a market pullback in October, BTIG analysts pointed out that as long as the index stays above 5670, a strongly bearish stance is challenging to justify.

The report also highlighted small-cap stocks, which have benefitted from a recent 50 basis point interest rate cut and improving economic conditions. Although they are performing better in absolute terms, their relative performance is still lacking. Analysts believe this trend could shift after October, potentially allowing small-cap stocks to outperform later in the year.

On an individual stock basis, BTIG noted that Meta Platforms is experiencing a breakout in both absolute and relative terms. In contrast, Microsoft is showing signs of weakness, reaching one-year relative lows. Despite Microsoft’s underperformance, the overall software sector is faring better, demonstrating resilience.

Furthermore, there has been noticeable weakness among homebuilders, whose relative strength peaked in mid-September. Analysts expressed concern about the homebuilders’ ability to maintain recent performance amid shifting market conditions.

Overall, BTIG expects the S&P 500 to remain range-bound with no dramatic price movements prior to the election, although they are monitoring the potential for further volatility in October.

GOOGL

GOOGL  META

META