Fed Cuts Stimulus Program but Maintains Low Rates

The Federal Reserve announced on Wednesday that it will begin tapering its economic stimulus program starting next month, while maintaining low interest rates to support ongoing economic recovery.

The U.S. central bank plans to decrease its bond-buying program, currently at $85 billion a month, by $10 billion each month commencing in January.

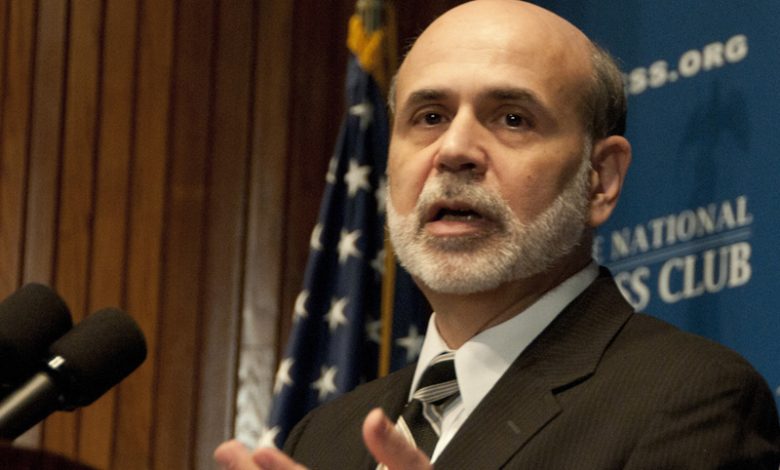

In his final press conference, outgoing Fed Chairman Ben Bernanke expressed confidence that the economy continues to show signs of improvement.

“Today’s policy actions reflect the assessment that the economy is continuing to make progress, but that it also has much farther to travel before conditions can be judged normal,” he stated.

The Fed indicated that interest rates are expected to remain low for an extended period, “well past the time that the unemployment rate declines below 6.5%, especially if projected inflation continues to run below” the target rate of 2%.

“The action today is intended to keep the level of accommodation the same overall and to push the economy forward,” Bernanke added. He emphasized the commitment to addressing inflation and getting it back to the target level.

He also mentioned that the bank intends to reduce asset purchases at a gradual pace of $10 billion per month throughout the following year, depending on continued improvements in the labor market.

“Continued progress is by no means certain,” Bernanke cautioned, noting that future steps will be guided by economic data.

He confirmed that Fed Vice Chair Janet Yellen, who is expected to succeed him when he steps down on January 31, fully supported the decision to begin reducing monetary stimulus.

Yellen is anticipated to receive Senate confirmation in a vote scheduled for later this week to take over as the next Fed Chair.

GOOGL

GOOGL  META

META