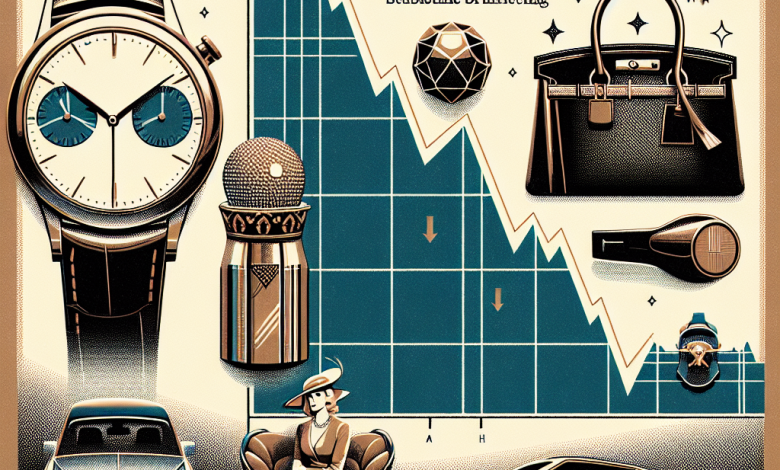

European Luxury Shares Decline After Disappointing Chinese Stimulus Briefing

European Luxury Stocks Decline Amid Disappointment over Chinese Economic Signals

Shares of European luxury brands fell in mid-morning trading on Tuesday as analysts expressed disappointment over the lack of new fiscal stimulus measures announced by Chinese officials.

During a press conference, the chair of China’s National Development and Reform Commission (NDRC) stated that the government is confident the country’s economy will meet its growth target of approximately 5% this year. However, no new fiscal initiatives were introduced to supplement the support policies rolled out last month, leaving investors underwhelmed.

This muted reaction impacted Chinese stocks, curbing significant gains seen after the markets reopened following the Golden Week holiday.

European luxury stocks, such as those owned by the LVMH group, Kering, Burberry, and Hermès, experienced declines. These high-end brands are particularly sensitive to changes in the Chinese economic landscape, as a substantial portion of their business is derived from that market. Analysts estimate that Chinese luxury consumption could eventually account for 35-40% of global spending on luxury goods.

Other European sectors also affected include mining and automobiles, which are similarly exposed to economic fluctuations in China.

In September, Chinese officials had announced a comprehensive set of measures, including significant interest rate cuts and reduced mortgage costs to stimulate growth.

Additionally, the People’s Bank of China introduced a swap program valued at 500 billion yuan to facilitate easier access to funding for purchasing stocks by funds, insurers, and brokers. The central bank also committed to providing up to 300 billion yuan in low-interest loans to commercial banks to support funding for share purchases and buybacks by publicly listed companies.

Following the initial announcement of these measures, Chinese stocks experienced a major rebound, with equities reaching their highest single-day gain in 16 years on September 30, the last trading day before the October holidays.

GOOGL

GOOGL  META

META